Tips on How to Collect Money from Non-Paying Customers

Tired of playing cat and mouse with clients who won’t cough up the cash? You’re not alone!

Late payments and disappearing acts are all too common in the world of freelancing and small business. 71% of freelancers struggle to collect money from clients who won’t pay at some point.

Moreover, pursuing overdue payments not only consumes your time but also depletes your financial resources, knocking financial management out of the window.

It takes your attention away from more crucial tasks like honing your skills and building a business.

So don’t let the chase consume you – let us help you get paid on time and get back to the important stuff!

Whether you are new to freelancing or have worked in this industry for a long time, this guide is the key to unlocking a wide range of techniques for getting paid, leaving no stone unturned.

Before we dive deeper into the tips on collecting payment, let’s first understand the fundamentals – why do clients not pay on time?

6 Reasons Why Clients Don’t Pay On Time

- The client is conditioned to a stretched timeline

- The client doesn’t have the time to pay you

- The client has cash flow issues

- There is a communication gap between you and your client

- There are some disputes or disagreements when it comes to the terms agreed

- The client has no intention to pay you anymore

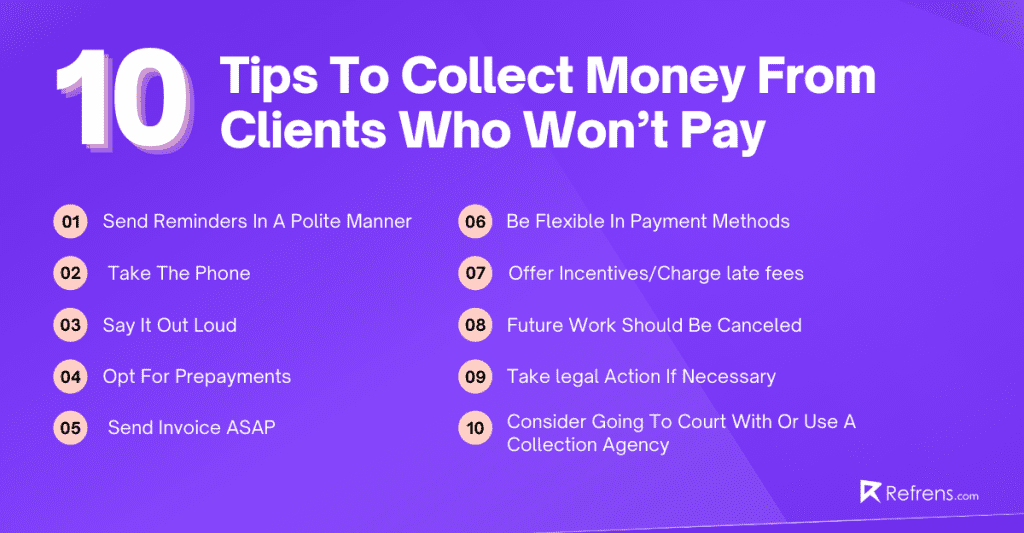

Now that you’re aware of the reasons, it might get easier to resolve these issues. Here is our compiled list of 10 tips of how to collect money from clients who won’t pay.

10 Tips On How To Collect Money From Clients Who Won’t Pay

Put an end to the worry of how to collect money from clients who won’t pay. The strategies outlined here can help you get payments from your clients on time or ahead of schedule.

1. Send Reminders In A Polite Manner

The first thing you should do to collect money from clients who won’t pay is to send a friendly reminder email as soon as possible.

To simplify, you can send personalized emails to multiple clients at once with email sequence software.

To boost your chances of getting paid, you can use a payment reminder email template to help you compose a pleasant and professional email.

Notify the client that the invoice is past due and provide a payment deadline. Remind them of the payment options you accept, as well as any late fees that may be included in your terms of payment. For reference, attach the original invoice to the email. Consider using a QR code generator to provide a scannable code for clients to pay your invoice in an instant.

2. Take The Phone

If you send email reminders to collect money from clients who won’t pay, your next action should be to pick up the phone and speak personally with the client. When you call, be courteous and friendly, just like you were with your email reminders.

Inquire about the problem that is keeping you from obtaining payment and try to come up with a solution. Secure payment over the phone if possible by obtaining a credit card number. If not, get your client to commit to sending your money by a certain date.

3. Say It Out Loud

Set the payment terms clear at the beginning itself. Make sure your clients have a fair understanding of the terms before the agreement is signed or the work commences. Doing this ensures that your clients are aware of your payment process and your expectations.

This method also reduces the chances of any confusion in the future. Mutual understanding by both parties on payment amount, timeframe, methods, late fees charged, and legal action is crucial. Apart from being vocal about these, ensure to include these terms in your essential documents like proposals or freelance contracts.

4. Opt For Prepayments

Once you have set forward the terms, request for an early payment whether full or partial. This ensures safety, especially with clients whom you are working with for the first time.

Initially, you will be apprehensive about asking for payment even before delivering work to your high-paying clients. However, doing this makes the client engaged in the work, prioritizes your deal, and helps you in maintaining your cash-flow cycle.

If collecting payment is intimidating, go for the second option of asking for a refundable deposit. It helps to conform to the client’s hesitation about you not living up to your commitment.

5. Send Invoice ASAP

The sooner you send the invoice, the earlier you receive your payment as the client sees the urgency. Also, as the work is fresh in your mind, it reduces the occurrence of mistakes on the invoice part. Which otherwise would lead to delayed payment.

Mention the payment dates clearly in the invoices sent. Make sure that the date is not too far in the future, it may get delayed.

Moreover, if the due date is near, you can send a follow-up email for long-period-based freelance contracts. If the client recognizes your quickness, they tend to prioritize your payment.

Another tip is to make your invoice stand out. Create a simple, streamlined, and easy-to-read invoice. Make sure the client can easily find the necessary information as it helps them in remembering it.

6. Be Flexible In Payment Methods

It’s time for your clients to pay you; make this process easier for them by being open and accepting payment through multiple mediums. Many freelancers and small businesses have international and long-distance clients looking for ways for making online payment easy and convenient for them.

Go for international payment gateways like Refrens.com, as it accepts all the major cards and supports more than 90 currencies. Try and link your invoice to your payment gateway. The quickest way to receive payment early is to make the process uncomplicated and painless. The solution here is to allow flexibility by diversifying your payment methods.

7. Offer Incentives/Charge late fees

Missed payment deadlines are a quick headache for any freelancer. When a client keeps procrastinating on your payments, try following up twice-thrice past the due date.

In the follow-up process, make sure you specify the terms of additional late payment fees (mention them in the invoice sent earlier) as discussed before, to be charged by you on them. During the follow-up, be polite and show gratitude.

You do not want to mess up your relationship with the client and lose them. Charging late payment fees encourages the clients to be prompt in making payments next time.

The other side of the coin is acknowledging the clients who pay early through small discounts to appreciate them. A quite effective method is ‘Early payment discount’ which is commonly practiced by many.

Else, you can use any other form of reward to help your clients develop a habit of paying without delay or promptly. Make them understand that you value their timeliness.

8. Future Work Should Be Canceled

If you’ve tried everything else and still can’t get the money, it’s time to cut the client off from other work until you get paid. It not only gives them an incentive to pay so they can move on to other tasks, but it also protects you from losing even more time and money to an untrustworthy customer.

9. Take Legal Action If Necessary

If your customer refuses to act after you’ve tried the above stages, it’s time to take legal action. Have your lawyer prepare a demand letter, which is a certified written document that threatens legal action if the debt is not paid. Clients who aren’t intimidated by a business’s letters and phone calls are typically enough threatened by a demand letter to pay up.

10. Consider Going To Court With Or Use A Collection Agency

Your lawyer can also advise you on whether it is worthwhile to do so, how likely you are to be paid, and what his or her fee would be.

You can use a collection agency if you don’t want to get involved in a court proceeding. Collection agencies usually take a percentage of the money they recover for you; in some cases, they’ll buy your debts outright and manage the collection.

In any situation, you’ll probably only get a small portion of the total. Before you choose one of these methods, weigh the potential outcomes—including the customer’s bad will—against the collection agency or attorney’s expenses.

You want to follow both of these options as you will face a variety of clients over time and you want to know how to collect money from clients.

Summary

Receiving payment is critical to the success of your business. It starts with the contract and then moves on to a simple procedure if the client refuses to pay.

It may be as simple as making a phone call or recommending appropriate payment choices, such as automated repeating payments. Sometimes you’ll need to call in the heavy guns, such as an attorney, a collection agency, or an arbitrator.

With these strategies, you know how to collect money from clients who won’t pay. Now is the time to choose Refrens and put an end to the headaches of clients who won’t pay.